UPDATES

Stay up to date with legislative changes, and best practices impacting the payroll profession

nETWORKING

Network with Payroll Professionals, build foundations that will advance your career

EDUCATION

Participate in our meetings, or join our Study Groups to help you earn your FPC or CPP

COMMUNITY gIVEBACK

Help us give back to our community and support other local non-profit organizations

Advancing Payroll,

Empowering People

We empower payroll professionals with up-to-date education and resources, enhancing their skills, knowledge, and recognition in today’s evolving business climate and legislative landscape.

Latest news

Stay informed with the latest payroll updates, industry trends, and chapter announcement. Make sure to also visit our NEWS & UPDATES section for our previous news and announcements.

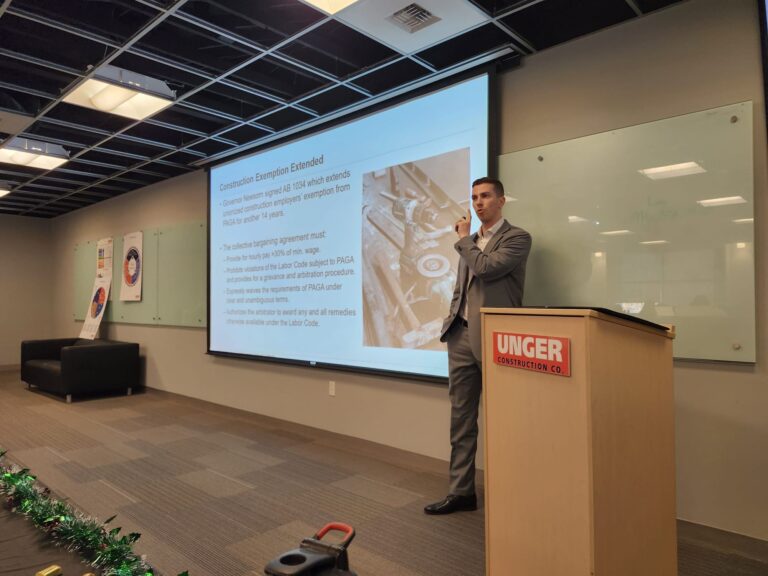

Previous Events

Expanding payroll knowledge, one day at a time…

Join us! It will only take a minute

contact information

write us or contact us on our social media

Please set the ‘Contact Form’ component shortcode